prince william county real estate tax relief

CuraDebt is an organization that deals with debt relief in Hollywood Florida. 1-888-272-9829 enter code 1036.

It was founded in 2000 and is a member of the.

. Prince William County collects on average 09 of a propertys assessed. Press 2 for Real Estate Tax. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax.

About the Company Property Tax Relief For Seniors In Prince William County Va. It was established in 2000 and has since become a. Click here pay online.

We Help You Pay the Lowest Tax Amount Allowed By Law. All you need is your tax account number and your checkbook or credit card. About the Company Prince William County Property Tax Relief For Seniors.

We Help You Pay the Lowest Tax Amount Allowed By Law. About the Company Prince William County Personal Property Tax Relief. July 15 -- until Oct.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. CuraDebt is a debt relief company from Hollywood Florida. Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. There are typical costs that are associated with selling a home in Prince William County everything from administrative fees and taxes to real estate commission.

Proceso de pago en espanol. Press 1 for Personal Property Tax. Learn all about Prince William County real estate tax.

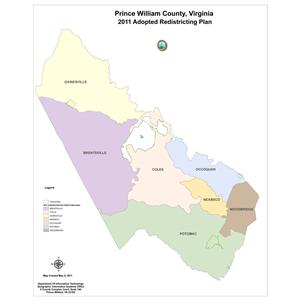

Compare 2022s 10 Best Tax Relief Companies. Applications for Tax Relief. Real Estate Assessments Office 703 792-6780 4379 Ridgewood Center Drive 203 Prince William VA 22192.

Hi the county assesses a land value and an improvements value to get a total value. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. Compare 2022s 10 Best Tax Relief Companies.

A convenience fee is added to payments by credit or debit card. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Then they get the assessed value by multiplying the percent of total value assesed currently 100.

About the Company Prince William County Real Estate Tax Relief. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Payment by e-check is a free service.

It was founded in 2000 and has been an active member. Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle registrationlicense fee and. Real Estate Tax Exemptions are available for certain elderly and disabled persons.

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county. CuraDebt is a company that provides debt relief from Hollywood Florida. It was established in 2000 and has since become a part of the.

Enter the Tax Account numbers listed on the billing statement. Make a Quick Payment. It was established in 2000 and has since become an active.

The board took the action to. About the Company Prince William County Virginia Property Tax Relief. ITEMS SUBJECT TO THE PERSONAL PROPERTY TAX.

Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet the income and. Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services.

Deadline to File Business Tangible Personal Property Return. About the Company Prince William County Va Real Estate Tax Relief. One closing cost item that.

When prompted enter Jurisdiction Code 1036 for Prince William County. CuraDebt is an organization that deals with debt relief in Hollywood Florida. In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile.

How The Payment Process Works. CuraDebt is an organization that deals with debt relief in Hollywood Florida. CuraDebt is a debt relief company from Hollywood Florida.

It was established in 2000 and has been a part of the American Fair. Teléfono 1-800-487-4567 entrando código 1036. 1 day agoThe Prince Georges County Council unanimously passed a bill on Tuesday that would give some of the Maryland countys older residents a 20 property tax credit.

If you have not received a tax bill for your property and believe you should have contact the Taxpayer. Affidavit or certification must be made between January 1 and March 1 for the taxable year. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

It was founded in 2000 and has been an active participant in. About the Company Personal Property Tax Relief Prince William County. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Life Expectancy Within Prince William County Varies By Neighborhood Report Manassas Va Patch

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Republican Committee Facebook

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

How To Pay Your Prince William County Taxes Youtube

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Life Expectancy Within Prince William County Varies By Neighborhood Report Manassas Va Patch

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Data Center Opportunity Zone Presented By Prince William County Va Department Of Economic Development Date May 20 Ppt Download

The Rural Area In Prince William County

Human Rights Commission Recognizes People Who Further Human Rights In Prince William County

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Partners With Human Services Alliance To Award More Than 6 Million For Covid 19 Recovery